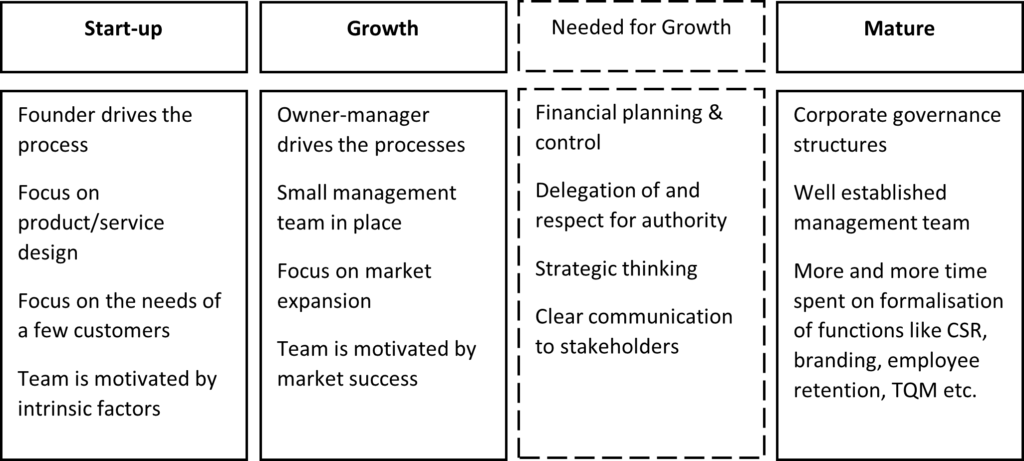

Business growth always follows the same pattern, yet it is so often misunderstood or disrespected.

Almost every business starts with the initial idea, a founder or a founding team and lots of business modelling. During the first months or even years the founders try to establish their market. The first few customers are not a big challenge, early adopters and friends of the business are enthusistic and ready to buy. But then, growing above 100 customers isn’t that easy and requires real good business growth management. Let’s assume the product or service is marketable, meaning quality is right, demand is there and pricing is fair. What does it entail for management to engage in a business growth process? Let’s first look at the basic business growth stages.

During the start-up phase the founders are engaged in almost every process. They hire people, develop products or design services, they market the company and often stand behind the counter selling. Founders might not be multi-talents, but they do many things, take the lead and show the people how they want the company to take shape. Because of that level of involvement, they often don’t have the time to work on strategy, financial planning or control. They do things, make them happen and see how it goes. The earliest delegation of work is that they hire an accountant who takes care of tax payments.

If the company still exists and strives after some time, we expect the company to continue growing. Well, many companies stay at that basic level and are complacent with it. Mind you that small teams find it easier to function, they are closer to a ‘natural span of control’. Business growth often requires investments that the owner-managers don’t have and they are not always ready to take a risk. So let’s be clear, business growth needs the business growth intentions of the owner.

With business growth intentions we have one important aspect covered: motivation. When it comes to capacity-building of small owner-managed firms, a highly motivated owner-manager is key to success. Business growth requires changing things, formalising operational procedure, thinking about which talent to hire next etc. Too much formalisation too early demotivates people, too little too late cripples growth. Here is what must be done from a quite early time of business establishment no matter how big you want to grow.

Record-keeping

Keeping basic records of financial transactions is often neglected and when it comes to establishing financial management we regret it because the financial history of the early days is not available without good business records. There are many records a company can and should keep, but records of sales and purchases are most vital. For those businesses which have lots of expensive assets it is important to have a fixed asset register that goes beyond bare registration and allows monitoring of asset utilisation too. For many companies it makes sense to add names of customers to the sales book. Imagine you greet your customers by name, that will have a positive impact on customer loyalty. By the way, segregation of private and business funds is a must.

Financial Management (projections and control)

With a simple salesbook, a purchasebook and some kind of records on cash and inventory we can produce a Profit & Loss Statement. With a fixed asset register, records on creditors and debtors we can also establish the Balance Sheet. Small owner-managed firms don’t need much more than that for managing their business growth.

Let’s get that clear, we talk about Management Accounting which has an internal focus and provides management with timely and reasonably accurate information so the owner-manager can make better business decisions. Financial Accounting on the contrary has an external focus, needs to be pretty accurate but doesn’t need to be timely. Financial Statements are usually not ready before March the following year.

| Financial Accounting | Management Accounting |

| Outside perspective | Inside perspective |

| Compliance | Performance |

| Information to others | Information for better business decisions |

| Analysis | |

| Let the accountants do it! | Owner-manager needs to get involved! |

Any entrepreneur should be interested in running a profitable business, always have enough cash to pay bills and over time grow the net-worth of the company. These are three simple things that a financial management system must address. A simple dashboard can show all three numbers (profit, cahs and net worth), and a few more, in one easy-to-read excel sheet. The dashboard shows on a monthly basis Sales, Cost of Sales, Gross Profit, Overhead Cost and Net Profits.

| January | February | … | ||

| Sales | ||||

| minus | Cost of sales | |||

| equals | Gross Profit | |||

| minus | Overhead Cost | |||

| equals | Earnings Before Interest & Tax (EBIT) |

Below this section of the Profit & Loss Statement we can add some numbers from the Balance Sheet like Fixed Assets, and Working Capital (Inventory minus creditors plus debtors minus cash). With good record-keeping practice this dashboard can be updated weekly and it provides the business owner with good information on business performance.

| January February March … | |

| Fixed Assets | |

| Inventory | |

| Trade Debtors | |

| Creditors | |

| Cash and bank balances |

With good information on company performance we can plan for business growth, without it we can only estimate. This is the little formalisation a business owner needs to install, as early as possible. As we establish good business records we also exercise control. Where is all the sales revenue gone? Invested into assets, not collected from trade debtors, sitting on the bank account or all ‘ploughed back’ into inventory? If we can’t see it in these positions then it might be ‘misused’. It is worth-while taking a few hours to analyse the financial records.

The time and efforts an owner-manager invests into record-keeping and financial management provides vital information for business growth. The question should be ‘how can we improve our profits?’. More customers, yes, but only the ones we like. Saving costs, well that is often not the issue for small firms. More products on the shelf, yes. We realize that in the dialogue with the owner-manager that through the dashboard we talk about business and not so much about record-keeping and accounting and it is commonly known that entrepreneurs like talking about their business. So working with the dashboard business owners work more on the business and less in the business.

Go-to-Market Strategy

Marketing strategy sounds too corporate to me, working with owner-managed small firms I think of the question how we go to the market with our product, hence Go-to-Market Strategy is my preferred term. The owner-manager must have a clear understanding of markets, market size, customer groups and and make a good selection. There are many things to be discussed, explored and put in place. At the end of the process, the small firm should have successfully established its markets and have a good value proposition defined.

Business Linkages as Incentive

Our business growth discussion becomes much more tangy now, and the small firm is much better understood. We know what the business can do, how past performance was and see that the way forward makes sense. At least that should be the outcome of a sound dialogue on business growth of a small owner-managed firm. A little investment into formalisation of the firm and we yield great results.

I want to come back to our initial presumption that the motivation of the owner-manager is a key success factor. Motivation of owner-managers of small firms often stems from an activity-based process, relevance to the owner-manager and a commercial incentive that can be obtained within a short time. Without these three criteria in place it will be difficult to keep the owner-manager on board. The good thing is that the incentive almost comes automatically. A company that is well managed, has good records and financial controls in place, and has a market that is defined and accessible, can easily be linked to marketplaces and large business partners.

Business Linkages can be a commercial incentive. Banks and leasing companies, large producers, impact investors and support organisations are all on the outlook for that company that has financial statements and is well positioned in its market.

At Tukumuka Consulting we provide management consulting, help to build a meaningful engagement with owner-managed small firms and work on systemic change that promotes an inclusive economy.

This blog is part of a series on owner-managed small firms in Zambia.

Recommended literature for further reading:

2006, Sara Carter and Dylan Jones-Evans, Enterprise and Small Business, Prentice Hall

2003, Peter Wilson and Sue Bates, The Essential Guide to Managing Small Business Growth, Wiley

1990, Allan Gibb, Training the Trainers for Small Business, Journal of European Industrial Training. Vol.14. No.1.

2007, Carol S Dweck, Mindset, Random House